fjrigjwwe9r3SDArtiMast:ArtiCont

tPara>

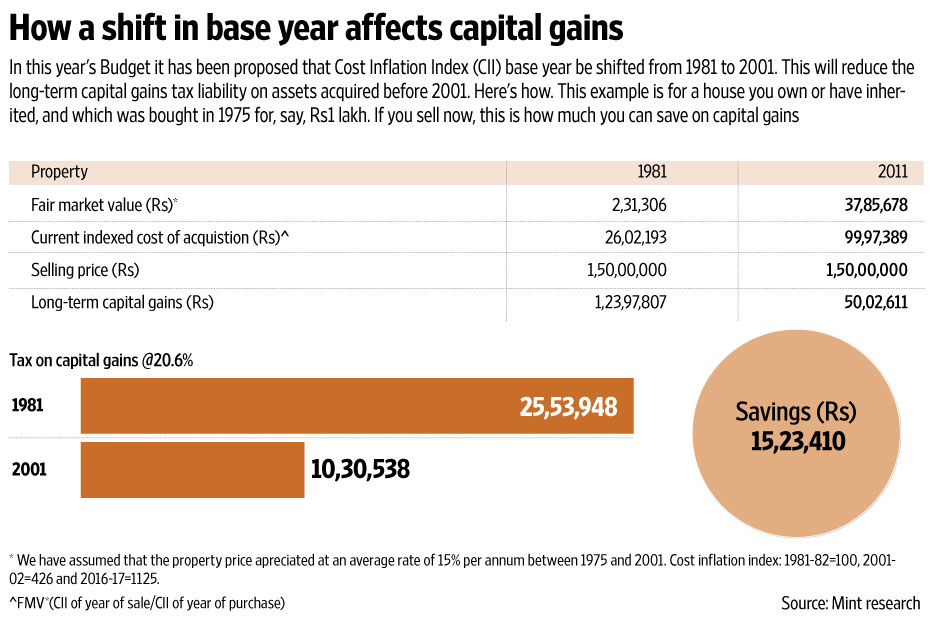

The base year for Cost Inflation Index is set to change from 1981 to 2001. This can bring down the long term capital gain tax liability considerably

If you own assets such as real estate, jewellery or bullion, which were bought before 2001, and are planning to sell them, then chances are your tax liability on gains you would make by selling them, will most likely come down significantly. The finance minister in Union Budget 2017 has proposed to move the Cost Inflation Index (CII) base year from 1981 to 2001. We know that this will bring down the long-term capital gain (LTCG) tax liability for sellers, on assets that were acquired before 2001. Here we explain how that would happen.

Capital gains

Profit or gain arising from the transfer of a capital asset like property, gold, shares or bonds is considered capital gain, and is taxed under the income head ‘capital gains’.

There are different rules for determining the taxation of different capital assets. For instance, capitals gains from transfer of shares before 1 year is considered as short-term capital gains (STCG) and taxed at the rate of 15.45% (including cess), whereas gains from shares transferred after a year of holding are LTCG and are exempt from taxes.

As far as real estate is concerned, gains from transfer of property within 3 years of its purchase are considered to be STCG, whereas gains from transfer of property after 3 years are classified as LTCG. In case of immovable property, LTCG is taxed at the rate of 20.6%, with indexation, and STCG gets added to the seller’s income and is taxed as per the income tax slab rate applicable to the individual.

Base year

In order to calculate the LTCG, the property seller should calculate the indexed cost of acquiring the property. To arrive at the indexed cost, the seller has to multiply the purchase cost of the property he owns with the CII—as notified by the tax authorities in the year of sale. This number then has to be divided by the CII of year of purchase. You can find all the CIIs on www.incometaxindia.gov.in.

However, in cases where the property was bought before the base year of CII, one needs to know the fair market value of the property for the base year. To understand it better, let us illustrate this and take the case of a person who bought a property for Rs1 lakh in, say, 1975, and is planning to sell the same now.

As per the present income tax rules, to calculate the capital gains on the property, she will first need to know the fair market value of the same in 1981. This number will then have to be inflated according to the CII numbers, to find out the present indexed cost of acquisition. If we assume that property rates have appreciated at the rate of 15% per annum, then the fair market value of the property bought in 1975 would be about Rs2.31 lakh in 1981. Based on this, the current indexed cost of the property would be about Rs26.02 lakh. The calculation is: Rs2.31 lakh *(1125/100). Here, 1125 is the CII for 2016-17)and 100 is the CII for 1981-82. Further, if the property is currently selling at Rs1.5 crore, the capital gain would be Rs1.24 crore, and LTCG tax would be Rs25.54 lakh.

However, with the proposed change in the base year, from the next financial year, one would have to calculate the fair market value of the property as it was in 2001. The shift in the CII base year from 1981 to 2001 will drastically change the final capital gains amount from the property. This is so because, “property prices appreciated at a much higher rate between 1981 and 2001, compared to the increase in CII,” said Amit Maheshwari, managing partner, Ashok Maheshwary & Associates LLP. So, the property valued at Rs2.31 lakh in 1981 would be valued at Rs9.84 lakh in 2001 [Rs2.31*(426 (CII 2001-02)/100 (CII 1981-82)], if we take into account the CII.

On the other hand, if we assume that the property price appreciated at a high rate of, say, 15% per annum during the same period, then the fair market value of the property would have been about Rs37.86 lakh in 2001. Further, based on the fair market value of the property in 2001, the inflated cost of acquisition at present would be about Rs99.97 lakh (Rs37.86*(1125/426)). In such a case, the LTCG would be around Rs50.03 lakh, and the tax liability would be Rs10.3 lakh. This means that the shift in the base year would result in savings of about Rs15.24 lakh (Rs25.54 less Rs10.30) if you decide to pay tax on the LTCG.

LTCG tax planning

One can avoid paying tax on the LTCG, if the capital gains are reinvested in a residential property within the next 2 years or you get a property constructed within 3 years from the date of property transfer. You can also save on LTCG tax by investing the capital gains in specified bonds notified under section 54EC of Income-tax Act, 1961. However, there is a limit to the amount that you can invest and the maximum amount that can be invested in such bonds is Rs50 lakh.

In Union Budget 2017, finance minister Arun Jaitley also announced that additional financial instruments would be introduced in which LTCG can be invested to save taxes.

It was also proposed in Budget 2017 that from the next financial year, gains from selling an immovable property, such as land and building, held for more than 2 years at the time of transfer will be considered as LTCG, and taxed at the rate of 20.6% with indexation