fjrigjwwe9r3SDArtiMast:ArtiCont

progesterone naturelle

progesterone

taux Do not wait till the end of the financial year to make your tax-saving investments. Better to do them before the last date set by your employer to submit documents

Every year around this time, employees are asked to submit proofs of investments and expenses that qualify for tax deduction, in line with the declaration made by them at the beginning of the financial year. The actual investment can be more or less from what was stated earlier in the year. But if the required proofs of investment are not submitted before the given deadline, it will be considered as if the investment was not done yet. To avoid this situation, read about some of the things that need to be taken care of while submitting the proofs of investment.

The requirement

The declaration of planned investments and expenses help you avoid unnecessary tax deduction at source (TDS). According to income tax rules, it is the obligation of an employer to deduct TDS from the monthly salary of employees, based on the income tax slab applicable to them.

The collected TDS has to be deposited with the revenue department by the employer, by the seventh day of the corresponding month. However, employers are required to consider declarations made by the employee regarding investments at the beginning of the year and evaluate the taxable income and applicable tax accordingly.

Further, tax rules also require employers to verify the claims of the employees by asking them to submit proofs and adjust any differences in tax liability by adjusting the TDS in the remaining months of the financial year. “As per the income tax rules, there is no date specified for an employee to submit proofs of investment and expenses to the employer,” said Amit Maheshwari, partner, Ashok Maheshwary & Associates LLP .

“The companies are required to deduct the final tax liability of all employees in March and to have ample time to examine the documents and declarations of all the employees. They generally ask the employees to furnish it by December or January,” he added.

If you don’t submit the proofs

Where an employee has made any investments and expenses, and wants the employer to account for them while calculating her tax liability, it is necessary for the employee to furnish the proofs.

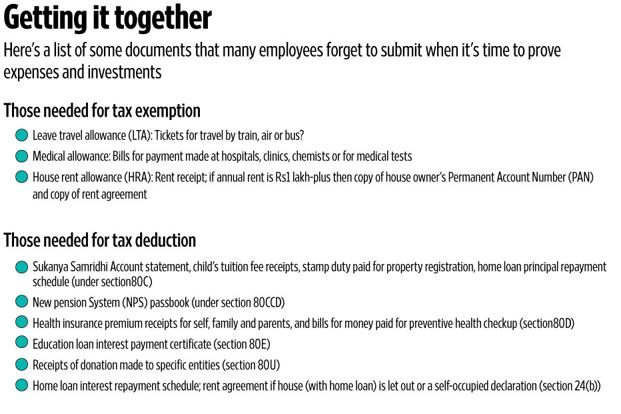

Proofs of investments and expenses may differ (see table). The employers need to collect the relevant proofs, and see if the employees have invested in the manner they declared. In case an employee fails to submit the proofs, “the employer will go ahead and calculate the tax liability of the employee without considering otherwise allowable deduction and exemption and will deduct full taxes accordingly,” said Vaibhav Sankla, director, H&R Block India.

However, if you are making a monthly contribution like investing in an equity linked savings scheme (ELSS) through systematic investment plans (SIPs) or monthly payments in a unit-linked insurance plan (Ulip), you may not be able to provide proof of such investments for upcoming months; such as February or March.

However, some employers take into consideration such commitments and allow employees to provide proofs till March, for investments planned in the last couple of months.

“If premium is due in February or March, then an employee can submit previous year’s receipts along with a declaration stating that she will submit the actual premium receipt before 31 March. If employer accepts this declaration then the employee will be saved from excess tax deduction,” said Sankla. Income tax department also gives some relaxation to the employers to consider such requests.

“For the month of March, the companies are allowed one month, i.e., time till 30 April to pay the TDS on salaries,” said Maheshwari.

Besides that, even if you fail to submit the proofs to your employer, you can still claim the deduction provided you make the investment in the qualified instrument before 31 March. But it can be claimed only when you file your income tax return.

However, some benefits can only be claimed through employer. For instance, exemptions related to leave travel allowance (LTA) must be claimed through the employer. As per the income tax rules, LTA can be claimed twice in a 4-year block; current block is 2014-18.

Similarly, medical reimbursements need to be claimed only by submitting bills to the employer; else the employer will deduct the applicable tax on the eligible amount and pay you the remainder at the end of the financial year.

Besides that, though an employee can claim house rent allowance (HRA) benefit while filing her income tax returns, it should be mentioned as a component of her salary.

Income tax rules do not require you to submit or attach any proof of investment or expenses along with your tax return, but make sure you retain the proofs of investment. In case of scrutiny, an assessing officer may demand the proofs to be furnished.

Mint Money take

It is better for employees to make tax-saving investments before the due date. If not, you will have to unnecessarily pay TDS, which will bring down your in-hand salary for the remaining months of the financial year.

Also, if you make tax-saving investments only in the last couple of months, this will be a double whammy to your financial plans, as you would get a lower salary due to TDS. Moreover, you would have to wait for TDS refund, which you would get only after you file your returns for that financial year.